RETAIL INVESTORS

Invest in Fractional U.S. Real Estate, Earn Dollar Income

Access pre-vetted, income generating U.S. properties through a secure digital platform. Invest with smaller amounts, earn dollar rental income, and build predictable passive returns without managing property yourself, through SEC aligned structures, dedicated U.S. property SPVs, and transparent reporting.

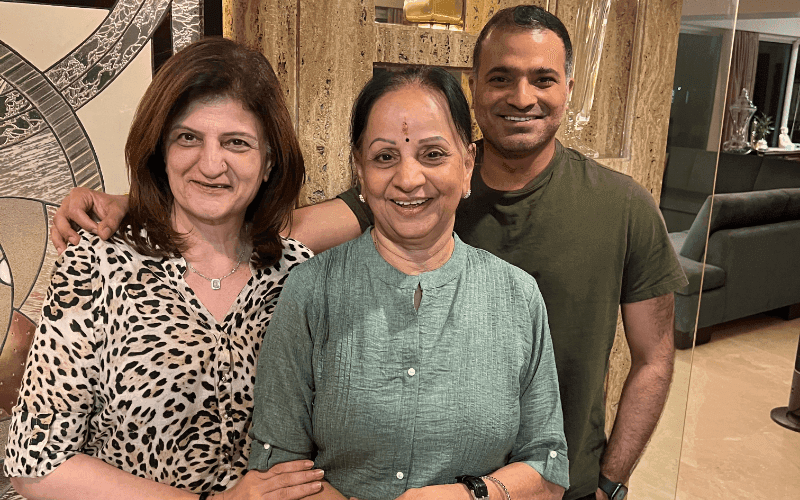

“Investing in U.S. real estate always felt out of reach for us. With Raveum, the clarity and transparency removed our fears completely. It finally felt possible to build global wealth with confidence.”

Priti & Sid, Delhi

OUR VALUES

Principles That Guide Our Investment Platform

Retail investors deserve clear, transparent access to high quality U.S. real estate without the complexity that often surrounds global investing. Raveum simplifies fractional U.S. property ownership through disciplined underwriting, transparent structures, and a secure digital platform, so investors can participate in income producing U.S. real estate with clarity and confidence.

Clear disclosures, real time reporting, and property level visibility so investors understand exactly how capital is deployed.

Access to institutional grade U.S. real estate opportunities structured with professional governance and controls.

Investment decisions driven by underwriting discipline, cash-flow durability, and downside protection, not speculation.

Emphasis on income producing U.S. real estate designed to support long term wealth building and financial stability.

OUR PROCESS

A Simple, Transparent Way To Invest in U.S. Real Estate

Start InvestingSEC Aligned Investment Framework

U.S. Regulatory Compliance

SEC-Aligned Structures and Cross Border Compliance

Investments are structured using U.S. compliant frameworks designed to meet SEC standards and applicable cross border regulations. Each offering follows defined legal, governance, and disclosure requirements to support transparency, investor protection, and long term regulatory alignment.

Start Earning

Institutional Grade Capital Protection

Institutional Custody, Underwriting, and Risk Controls

Investor capital is managed through secure, institutional-grade custody structures and disciplined underwriting. Each property undergoes defined due diligence, with documented ownership, risk controls, and ongoing operational oversight designed to emphasize transparency and capital discipline.

Build Portfolio

Transparent Ownership & Reporting

Clear Visibility into Ownership, Income, and Performance

Investors receive clear, structured visibility into ownership, rental income, and asset performance through standardized reporting. Data is presented consistently and updated regularly, enabling informed oversight across market cycles.

View Returns

U.S. Dollar Rental Income

Predictable Income from Income Producing U.S. Real Estate

Investors receive regular U.S. dollar income generated by operating properties, along with potential upside from long-term asset appreciation. Cash flows and value creation are supported by tenant fundamentals, lease structures, and disciplined asset management.

Get StartedINVESTOR EXPERIENCES

Success Stories from Real Investors

Experiences from global investors using fractional U.S. real estate to generate income, diversify portfolios, and build long term wealth through a regulated digital platform.

Manju Sharma

Amrita Ghosh Dastidar

U.S. REAL ESTATE INVESTMENT RESOURCES

Insights on Fractional U.S. Real Estate Investing

Real Estate Investment Compliance Explained: How Investor Protection Works

Learn how Raveum’s SEC aligned, audit ready compliance framework safeguards investor capital, and delivers institutional grade security for global investors in U.S. real estate.

Income vs Growth: How to Balance a Global Property Portfolio

Learn how balancing steady rental income with long-term property growth helps you build a strong global real estate portfolio.

Build a Global U.S. Real Estate Portfolio

Discover pre-vetted, income generating U.S. real estate opportunities available through a secure fractional investment platform.

Start Investing